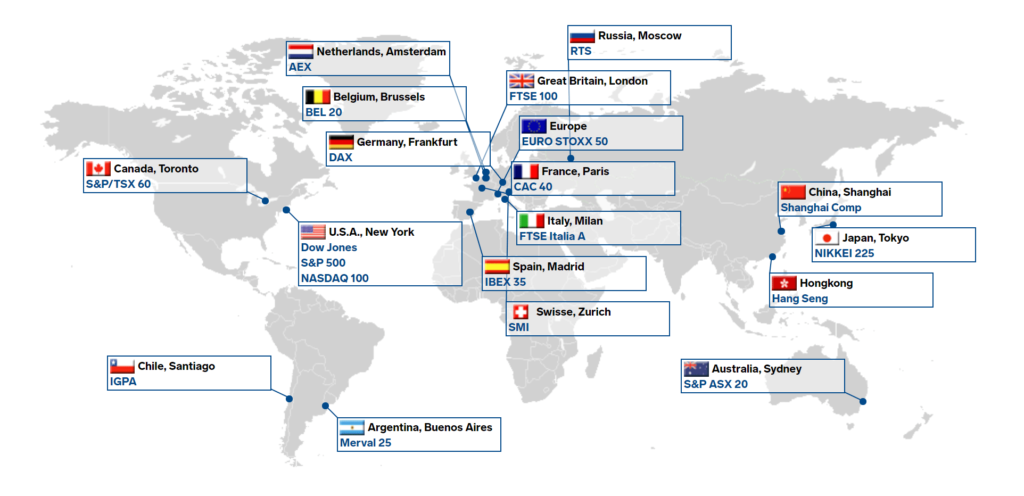

Global Stock exchanges are pivotal in facilitating the buying and selling of securities, such as stocks, bonds, and derivatives, and serve as crucial pillars of global economies. They provide platforms for companies to raise capital and for investors to trade financial instruments, influencing not just local economies but also the global financial system. Here, we will explore 15 major stock exchanges around the world, with India leading the list, given its growing economic significance and its rapidly expanding stock market.

1. Bombay Stock Exchange (BSE) – India

- Name: Bombay Stock Exchange (BSE)

- Country: India

- Established: 1875

- Market Capitalization: Over $3 trillion

- Overview: The Bombay Stock Exchange (BSE) is the oldest stock exchange in India and one of the largest in the Global Stock exchanges by market capitalization. It is located in Mumbai and lists a wide variety of companies across various sectors, including finance, energy, telecom, consumer goods, and automotive. The Sensex index, tracking the performance of the top 30 listed companies, is one of the most watched indices in India.

- Importance: The BSE is a cornerstone of India’s financial system and a critical hub for raising capital for businesses, particularly in emerging sectors like technology, renewable energy, and digital finance. With India’s growing economy, the BSE continues to play a major role in capital markets.

2. National Stock Exchange (NSE) – India

- Name: National Stock Exchange (NSE)

- Country: India

- Established: 1992

- Market Capitalization: Over $3 trillion

- Overview: The National Stock Exchange (NSE), also located in Mumbai, is the largest stock Global Stock exchanges in India by trading volume. It was established with the aim of bringing transparency to the Indian securities market. NSE is known for its high-frequency trading and the Nifty 50 Index, which tracks the performance of the top 50 companies listed on the exchange.

- Importance: As a leading exchange in India, NSE has established itself as a key player in the financial markets, attracting both domestic and international investors. Its technologically advanced trading system ensures liquidity and speed, contributing to the growing attractiveness of India’s stock market.

3. New York Stock Exchange (NYSE) – United States

- Name: New York Stock Exchange (NYSE)

- Country: United States

- Established: 1792

- Market Capitalization: Over $30 trillion

- Overview: The New York Stock Exchange (NYSE) is the largest stock exchange in the world by market capitalization. Located on Wall Street in New York City, it lists many of the Global Stock exchanges and most influential companies, including Apple, Microsoft, Tesla, and Visa. The NYSE uses an auction market model where buyers and sellers are matched in real-time by a human or automated system.

- Importance: As the world’s financial epicenter, the NYSE plays a critical role in capital formation and global economic growth. Its liquidity, regulatory framework, and extensive global reach make it the most significant stock exchange globally.

4. NASDAQ Stock Market – United States

- Name: NASDAQ Stock Market

- Country: United States

- Established: 1971

- Market Capitalization: Over $20 trillion

- Overview: The NASDAQ Stock Market is a fully electronic exchange known for its focus on technology, biotech, and growth-oriented companies. Many of the world’s most valuable companies, including Amazon, Google (Alphabet), and Microsoft, are listed on the NASDAQ.

- Importance: The NASDAQ is home to many leading companies in the technology and innovation sectors, making it an essential market for investors looking to gain exposure to the digital economy. The exchange is also known for its NASDAQ Composite Index, a key benchmark for the performance of tech-heavy stocks.

5. London Stock Exchange (LSE) – United Kingdom

- Name: London Stock Exchange (LSE)

- Country: United Kingdom

- Established: 1801

- Market Capitalization: Over $3.5 trillion

- Overview: The London Stock Exchange (LSE) is one of the oldest and most prestigious stock exchanges in the world. It is located in the financial heart of London and lists a wide range of Global Stock exchanges, including HSBC, BP, and GlaxoSmithKline.

- Importance: The LSE is not only a major European exchange but also serves as an international gateway for companies seeking to raise capital in global markets. The FTSE 100 Index, which tracks the top 100 companies listed on the LSE, is a widely followed benchmark in the UK and beyond.

6. Tokyo Stock Exchange (TSE) – Japan

- Name: Tokyo Stock Exchange (TSE)

- Country: Japan

- Established: 1878

- Market Capitalization: Over $5 trillion

- Overview: The Tokyo Stock Exchange (TSE) is the largest stock exchange in Japan and one of the largest in Asia. Key companies listed on the TSE include Toyota, Sony, and Mitsubishi.

- Importance: The TSE plays a crucial role in Japan’s economy and is a gateway for global investors seeking to gain exposure to Japanese companies and the Asian market. It is home to the Nikkei 225, Japan’s primary stock index.

7. Shanghai Stock Exchange (SSE) – China

- Name: Shanghai Stock Exchange (SSE)

- Country: China

- Established: 1990

- Market Capitalization: Over $7 trillion

- Overview: The Shanghai Stock Exchange (SSE) is the largest stock exchange in China. It lists a wide range of companies, particularly state-owned enterprises (SOEs) in industries such as energy, banking, telecommunications, and real estate.

- Importance: As China is the world’s second-largest economy, the SSE is a critical exchange for investors seeking to capitalize on China’s economic growth. It provides investors with access to the country’s largest companies, many of which are leaders in the global market.

8. Euronext – Multiple Countries

- Name: Euronext

- Countries: France, Netherlands, Belgium, Portugal, Ireland

- Established: 2000

- Market Capitalization: Over $4 trillion

- Overview: Euronext is a pan-European stock exchange that operates in multiple countries, including France, Netherlands, Belgium, Portugal, and Ireland. It is known for its diverse listing, with companies in various sectors such as banking, energy, telecom, and consumer goods.

- Importance: Euronext is a significant player in European capital markets and provides investors with access to leading companies from multiple European countries. Its CAC 40 Index is one of Europe’s most widely followed indices.

9. Hong Kong Stock Exchange (HKEX) – Hong Kong

- Name: Hong Kong Stock Exchange (HKEX)

- Country: Hong Kong

- Established: 1891

- Market Capitalization: Over $5 trillion

- Overview: The Hong Kong Stock Exchange (HKEX) is a major financial hub in Asia. It is known for its large listing of Chinese companies and has become a critical gateway for Global Stock exchanges seeking exposure to China. Companies like Alibaba, Tencent, and China Mobile are listed on the HKEX.

- Importance: HKEX plays a pivotal role in the economic relationship between China and the rest of the world. Its Hang Seng Index is a key benchmark for Hong Kong’s stock market performance.

10. Deutsche Börse – Germany

- Name: Deutsche Börse

- Country: Germany

- Established: 1585

- Market Capitalization: Over $2 trillion

- Overview: Deutsche Börse is Germany’s largest stock exchange and includes the Frankfurt Stock Exchange (FWB). It is home to many prominent German companies, particularly in the automotive, finance, and technology sectors.

- Importance: Deutsche Börse is a significant player in European capital markets and offers access to some of the most important companies in Germany, such as Volkswagen, Siemens, and BASF.

11. Australian Securities Exchange (ASX) – Australia

- Name: Australian Securities Exchange (ASX)

- Country: Australia

- Established: 1987

- Market Capitalization: Over $2 trillion

- Overview: The Australian Securities Exchange (ASX) is the primary stock exchange in Australia, listing companies from sectors like mining, banking, technology, and healthcare. It is known for its ASX 200 Index, which tracks the

performance of the largest 200 companies on the exchange.

- Importance: The ASX is the largest Global Stock exchanges in the Asia-Pacific region, offering investors opportunities to invest in Australia’s resource-driven economy.

12. B3 (Brasil Bolsa Balcão) – Brazil

- Name: B3 (Brasil Bolsa Balcão)

- Country: Brazil

- Established: 1890

- Market Capitalization: Over $1 trillion

- Overview: B3 is the main stock exchange in Brazil and is the largest in Latin America. It lists a variety of companies, particularly in the mining, energy, and financial sectors. It is also the gateway for foreign investors looking to access the growing Brazilian market.

- Importance: B3 plays a significant role in South America’s economy and provides exposure to the Brazilian market and its burgeoning industries.

13. Toronto Stock Exchange (TSX) – Canada

- Name: Toronto Stock Exchange (TSX)

- Country: Canada

- Established: 1852

- Market Capitalization: Over $2 trillion

- Overview: The Toronto Stock Exchange (TSX) is the largest stock exchange in Canada, hosting a broad range of companies across sectors like energy, mining, technology, and banking.

- Importance: As Canada’s economic hub, the TSX is a critical exchange for investors seeking exposure to the Canadian economy, particularly in natural resources and finance.

14. SIX Swiss Exchange – Switzerland

- Name: SIX Swiss Exchange

- Country: Switzerland

- Established: 1850

- Market Capitalization: Over $1.5 trillion

- Overview: The SIX Swiss Exchange is Switzerland’s primary stock exchange, listing leading companies in the banking, pharmaceutical, and technology sectors. It is known for companies such as Nestlé, Novartis, and Roche.

- Importance: The SIX Swiss Exchange is an important gateway for European and global investors looking to access the Swiss market, known for its stability and strong financial sector.

15. Singapore Exchange (SGX) – Singapore

- Name: Singapore Exchange (SGX)

- Country: Singapore

- Established: 1999

- Market Capitalization: Over $1 trillion

- Overview: The Singapore Exchange (SGX) is a prominent stock exchange in Southeast Asia, with a focus on companies from industries like banking, real estate, and technology.

- Importance: SGX is a leading exchange in Asia and serves as a hub for regional capital raising and investment.

Conclusion

Global Stock exchanges are crucial to the functioning of the global economy, and the exchanges listed above represent key players across continents. From India’s BSE and NSE, which are rapidly growing financial markets, to the established giants like the NYSE and NASDAQ, these exchanges provide investors with opportunities to diversify their portfolios and invest in sectors ranging from technology and finance to energy and natural resources.

Each Global Stock exchanges has its own unique market characteristics and trading environment, making it important for investors to understand the dynamics of each exchange before making investment decisions. The rise of emerging markets like India and China further highlights the growing influence of stock exchanges outside traditional financial hubs like the U.S. and Europe.

Wondering How to increase Credit card limit